Business

The Impact of SUI Tax on Seasonal Businesses

- /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://buzzark.co.uk/wp-content/uploads/2025/01/GettyImages-1221446772-Taxes-Treasury.jpeg&description=The Impact of SUI Tax on Seasonal Businesses', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 72

https://buzzark.co.uk/wp-content/uploads/2025/01/GettyImages-1221446772-Taxes-Treasury.jpeg&description=The Impact of SUI Tax on Seasonal Businesses', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

Seasonal businesses, which often experience fluctuations in staff during peak and off-peak seasons, face unique challenges when it comes to managing taxes and payroll. One of the key considerations for these businesses is the State Unemployment Insurance (SUI) tax. While it may seem like a straightforward cost, understanding how SUI tax impacts seasonal businesses is crucial for effective financial planning and compliance. Since seasonal businesses are required to pay SUI tax on wages paid to employees, it is important for business owners to understand the nuances of this tax and how it affects their bottom line. This article delves into the impact of SUI tax on seasonal businesses, shedding light on potential challenges and strategies to mitigate the financial burden.

Understanding SUI Tax and Its Relevance to Seasonal Businesses

SUI tax meaning refers to the tax levied by state governments on employers to fund unemployment benefits for workers who become unemployed through no fault of their own. For seasonal businesses, this tax is calculated based on employee wages during their time of employment. SUI tax meaning is crucial for businesses to understand, as it directly impacts payroll management. Seasonal employers may face challenges due to fluctuations in the number of employees during peak seasons, requiring careful accounting to ensure compliance and accurate tax calculations.

The Cost of SUI Tax for Seasonal Employers

The cost of SUI tax can be significant for seasonal businesses. As these businesses hire temporary workers, they may find themselves paying taxes for workers who are only employed for a short period. Employers must account for these costs as part of their budget, as failing to do so can lead to unexpected financial burdens. The SUI tax rate can vary by state and employer history, meaning that businesses must remain vigilant to avoid paying higher rates than necessary.

Navigating Seasonal Employee Classification

Correctly classifying employees is vital for managing SUI tax obligations. Seasonal businesses often hire workers on a temporary or part-time basis, but misclassification can result in penalties or overpayment of taxes. It’s essential to differentiate between employees and independent contractors to ensure compliance with state laws. Employers must also be aware of the specific regulations governing temporary workers and the implications for SUI tax liability.

Strategies to Minimize SUI Tax Impact

Seasonal businesses can take steps to minimize the impact of SUI tax. One option is to maintain a stable core workforce throughout the year, reducing the reliance on temporary workers. By doing so, businesses can often lower their overall SUI tax rate, as long-term employees help stabilize the tax calculation. Additionally, understanding the experience rating system and ensuring that seasonal layoffs are handled properly can help mitigate tax rate increases.

Leveraging Tax Credits and Incentives

Many states offer tax credits or incentives to businesses that hire and retain workers, including seasonal employees. By taking advantage of these opportunities, seasonal businesses can reduce their overall tax liability. Business owners should familiarize themselves with these incentives to maximize savings. Some states offer reduced SUI tax rates for employers who have not had a history of layoffs, making it essential for seasonal businesses to focus on retaining employees whenever possible.

Planning for Off-Season SUI Tax Implications

Off-season planning is essential for minimizing the financial burden of SUI taxes. Since SUI tax rates are typically based on the wages paid during the previous year, seasonal businesses must anticipate the tax liabilities incurred during peak season. By carefully forecasting payroll and tax obligations, seasonal businesses can better manage cash flow and avoid unpleasant surprises during off-peak periods when revenues are lower.

-

Celebrity11 months ago

Celebrity11 months agoMichael C. Hall: Complex Journey of a Versatile Actor

-

Business10 months ago

Business10 months agoUnderstanding Apostille UK: A Comprehensive Guide

-

Technology11 months ago

Technology11 months agoThe Future of Video Marketing: Trends You Can’t Ignore

-

Celebrity12 months ago

Celebrity12 months agoShane Urban Explained: Facts About Keith Urban’s Sibling

-

Celebrity12 months ago

Celebrity12 months agoAnuel AA Height and Weight? Everything Age, Bio, Family, and More

-

Celebrity12 months ago

Celebrity12 months agoWho is Heidi Berry Henderson? Everything About Halle Berry’s Sister

-

Celebrity12 months ago

Celebrity12 months agoThe Life of Lorenzo Luaces: Lili Estefan’s Ex-Husband Explained

-

Celebrity1 year ago

Celebrity1 year agoOtelia Cox, Bio Tony Cox’s Wife, Her Age, Height, and Life Journey

-

Celebrity12 months ago

Celebrity12 months agoian cylenz lee: Bio, net worth, age, family and more Kandyse McClure’s husband

-

Entertainment1 year ago

Entertainment1 year agoEverything About ‘Oche Oche Anasico’ Lyrics: Meaning, Origin & More

-

Celebrity12 months ago

Celebrity12 months agoWho is Carolin Bacic? A Deep Dive into Steve Bacic’s Wife

-

Celebrity12 months ago

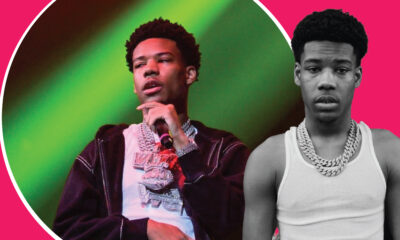

Celebrity12 months agoDiscover Nardo Wick’s Age, Net Worth, Biography, Family, and More