Crypto

How to Trade with Limited Capital?

- /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://buzzark.co.uk/wp-content/uploads/2025/02/image-13-1000x600.png&description=How to Trade with Limited Capital?', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 72

https://buzzark.co.uk/wp-content/uploads/2025/02/image-13-1000x600.png&description=How to Trade with Limited Capital?', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

Trading with limited capital might seem challenging at first, but it opens many doors if you start with a small amount. By consistently focusing on smart strategies, managing risk in a disciplined way, and continuous learning, you can gradually build your portfolio and gain lasting confidence in your trading decisions.

The Basics of Trading with Limited Capital

When you start trading in the stock market with limited funds, you need to set realistic expectations for long-term success. You need to understand that quick, massive gains are rare, and instead, steady progress over time is truly the key to growth. This will allow you to learn from small wins and slowly build confidence.

Moreover, choosing the right broker can make a huge difference when you’re trading with limited capital. This is because the right broker will help you effectively reduce unnecessary costs.

Reputable platforms offer low transaction fees, user-friendly interfaces, and helpful tools that are perfect for beginners. These brokerages will also ensure that more of your money goes into actual trading rather than fees, allowing you to maximize your limited capital.

Top Trading Strategies for Limited Capital

Here, let’s talk about the strategies you can use to trade with limited capital:

Fractional Share Trading

If your capital is limited, trading in high-priced stocks may seem impossible. However, many brokers now offer fractional share trading, which allows you to buy a portion of a stock rather than a whole share.

This enables you to gain exposure to high-value companies without needing a large amount. Fractional trading is ideal for beginners looking to trade without committing too much capital to a single stock.

Low-Cost Options Trading

Options trading can be risky, but when used strategically, it allows traders with limited capital to control large positions with small capital. Strategies such as buying call or put options require significantly less capital than buying stocks outright.

However, options trading requires thorough research and risk management since options expire within a set period. You should choose liquid options with high trading volume to ensure smoother trade execution and better pricing.

You can also trade in mini options, which are contracts that represent a smaller number of lots compared to standard options, i.e. 10 lots instead of 100. This smaller contract size makes them more affordable for traders with limited capital.

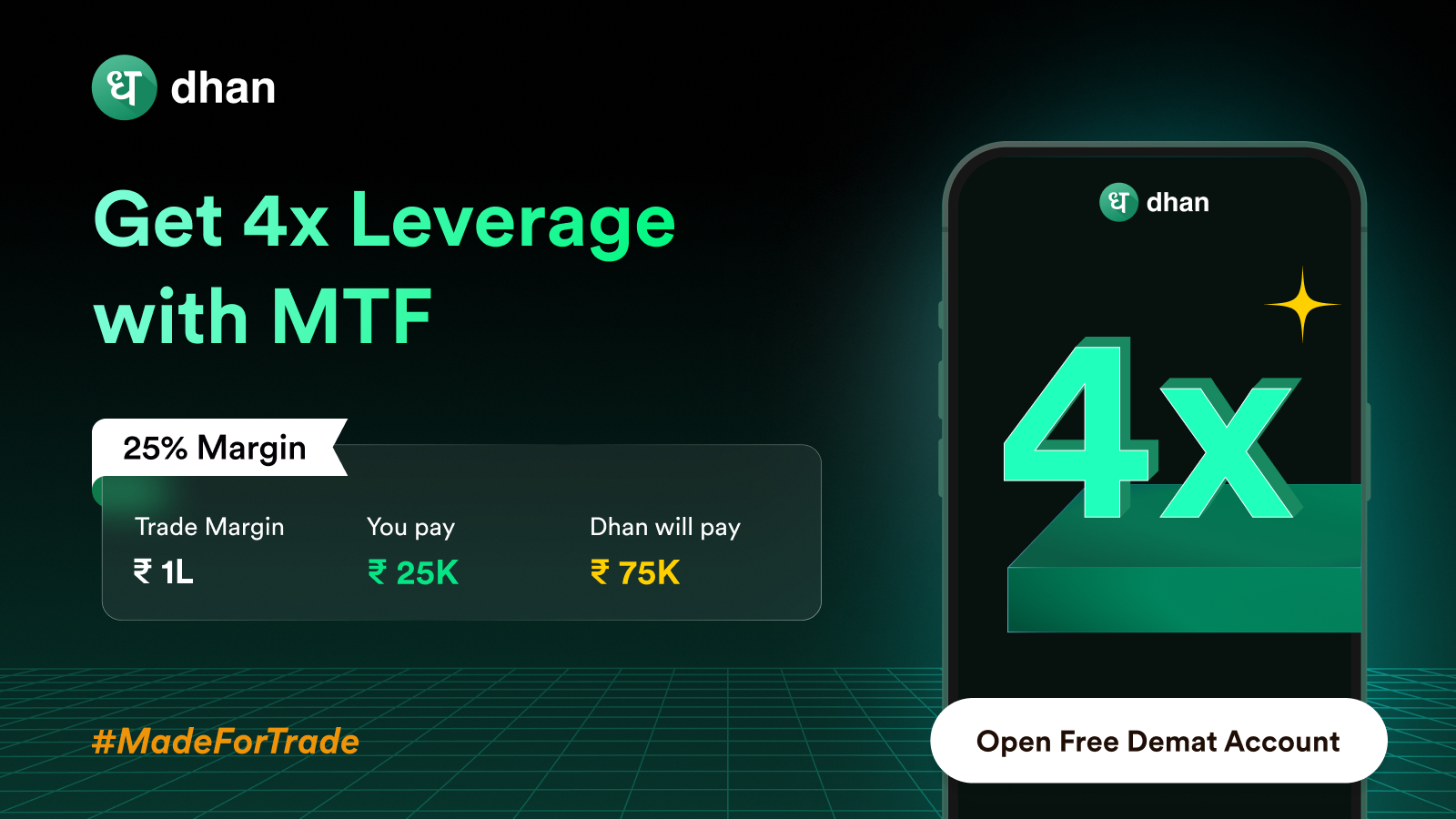

Use Margin Trading

Using the margin trading facility, you can place trades of larger positions with limited capital by borrowing funds from your broker. This leverage will help you maximize potential gains, but it also increases risks.

For example, let’s say you want to trade ₹2,00,000 in a stock that has a 25% margin requirement, which equals ₹50,000. You deposit ₹50,000 with the broker, and the rest ₹1,50,000, you get from your broker as a loan. This way, with a limited capital, you can place a larger trade. While doing this will amplify your potential profits, it also means that even small market movements against your position can lead to losses.

You should note that if your trade moves against you and your equity goes below the margin you’re required to maintain, you may get a margin call. This means that you will then have to deposit additional funds to keep your position open. To avoid this, you should start with small leverage, use stop-loss orders, and never risk more than you can afford to lose.

Conclusion

Trading with limited capital is not about taking high risks for quick profits but about making smart, calculated moves that maximize profits. By using the ways mentioned in this article, you can trade effectively with a small capital base. As you gain experience, you can refine your strategies, scale up your trades, and slowly build a stronger portfolio over time.

Read more for more amazing topic Buzzark.

-

Celebrity11 months ago

Celebrity11 months agoMichael C. Hall: Complex Journey of a Versatile Actor

-

Business11 months ago

Business11 months agoUnderstanding Apostille UK: A Comprehensive Guide

-

Technology11 months ago

Technology11 months agoThe Future of Video Marketing: Trends You Can’t Ignore

-

Celebrity12 months ago

Celebrity12 months agoShane Urban Explained: Facts About Keith Urban’s Sibling

-

Celebrity12 months ago

Celebrity12 months agoAnuel AA Height and Weight? Everything Age, Bio, Family, and More

-

Celebrity1 year ago

Celebrity1 year agoWho is Heidi Berry Henderson? Everything About Halle Berry’s Sister

-

Celebrity12 months ago

Celebrity12 months agoThe Life of Lorenzo Luaces: Lili Estefan’s Ex-Husband Explained

-

Celebrity1 year ago

Celebrity1 year agoOtelia Cox, Bio Tony Cox’s Wife, Her Age, Height, and Life Journey

-

Celebrity1 year ago

Celebrity1 year agoWho is Carolin Bacic? A Deep Dive into Steve Bacic’s Wife

-

Celebrity12 months ago

Celebrity12 months agoian cylenz lee: Bio, net worth, age, family and more Kandyse McClure’s husband

-

Celebrity12 months ago

Celebrity12 months agoDiscover Nardo Wick’s Age, Net Worth, Biography, Family, and More

-

Entertainment1 year ago

Entertainment1 year agoEverything About ‘Oche Oche Anasico’ Lyrics: Meaning, Origin & More