Business

A Comprehensive Guide to Expense Business Cards

- /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://buzzark.co.uk/wp-content/uploads/2025/02/image-8-1000x600.png&description=A Comprehensive Guide to Expense Business Cards', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/u433845138/domains/buzzark.co.uk/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 72

https://buzzark.co.uk/wp-content/uploads/2025/02/image-8-1000x600.png&description=A Comprehensive Guide to Expense Business Cards', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

Prepaid business cards are an effective tool for managing company expenses, offering a controlled and streamlined approach to spending. Unlike traditional debit or credit cards, prepaid business cards must be preloaded before any transactions can be made. The spending limit is directly tied to the amount preloaded, making these cards an excellent choice for businesses aiming to maintain strict financial control. When the balance is depleted, the card must be reloaded to continue facilitating purchases.

How Do Prepaid Business Cards Function?

Expense business cards operate similarly to standard debit or credit cards. They can be used for transactions at physical stores, online retailers, and even for ATM cash withdrawals, depending on the card issuer. These cards are typically funded through methods such as bank transfers, direct deposits, or ACH payments. Some issuers offer the added convenience of providing employee cards, which can be funded from a central account, allowing businesses to allocate budgets effectively across teams or projects.

Are Prepaid Cards the Same as Business Credit Cards?

While prepaid business cards and credit cards may seem alike at first glance, they differ significantly in how they are funded and used. Prepaid cards rely on preloaded funds, allowing you to spend only what has been added to the card. In contrast, credit cards provide access to a revolving line of credit. This key difference means that while prepaid cards don’t require a credit check to obtain, they also don’t help in building business credit.

For companies aiming to enhance their credit scores, secured business credit cards may be a better choice. These cards function similarly to prepaid cards, as a deposit determines the spending limit. However, unlike prepaid cards, secured credit cards report to credit bureaus, enabling businesses to establish or improve their creditworthiness over time.

What Are the Funding Limits for Prepaid Cards?

The maximum amount that can be loaded onto a prepaid business card varies depending on the card provider. In some cases, accounts may hold tens of thousands of dollars, though individual card limits are often set much lower. For instance, some cards may support balances of up to 100,000 EUR in the account but impose restrictions on per-card spending to manage risks and encourage responsible use.

Benefits of Prepaid Business Cards

l Controlled Employee Spending

Prepaid cards allow businesses to set precise spending limits, making it easier to manage budgets for specific teams, projects, or milestones. For instance, sales or marketing teams can be issued cards with allocated amounts to ensure spending stays within predefined parameters. Many prepaid cards also support virtual card creation, adding flexibility to expense management.

l Streamlined Expense Processes

Traditional reimbursement systems often require employees to pay for business expenses out of pocket and submit receipts for reimbursement, which can be time-consuming and burdensome. Prepaid cards eliminate this process, allowing employees to use company funds directly for approved expenses.

l Simplified Accounting and Tax Filing

Transactions made with prepaid business cards are automatically recorded and categorized, creating clean, organized records. This simplifies tracking business expenses and ensures accurate and efficient tax filings. Additionally, these detailed records can be invaluable during audits.

Drawbacks of Prepaid Business Cards

l Lack of Credit Building

Prepaid business cards do not contribute to building business credit, as they involve spending preloaded funds rather than borrowing. Businesses aiming to improve their credit history may need to explore alternatives like secured or corporate credit cards.

l Funding Limitations

The requirement to preload funds can tie up capital, and maximum card limits are often lower than those of credit cards. This can make prepaid cards less suitable for businesses with large-scale expenses or fluctuating cash flow needs.

l No Rewards Programs

Unlike many credit cards, prepaid business cards rarely offer rewards, cashback, or other incentives for spending. For small business owners seeking to maximize value from their purchases, this can be a significant disadvantage.

Alternatives to Prepaid Business Cards

Prepaid cards are a great tool for managing expenses, especially for startups or businesses seeking tighter control over spending. However, they might not be the best solution for all companies. Here are some alternatives:

Business Debit Cards

Business debit cards link directly to a company’s checking or savings account. They allow businesses to spend only the funds available in the account, eliminating the need for preloading. While convenient, debit cards also don’t build credit or offer rewards, similar to prepaid cards.

Corporate Credit Cards

Corporate credit cards offer a more flexible spending solution compared to prepaid cards. These cards allow businesses to accrue a balance up to a spending limit, which must be paid in full at the end of each billing cycle. Unlike traditional credit cards, corporate cards often include features like expense management tools, detailed reporting, and controls for employee spending.

Corporate credit cards also contribute to building business credit, as issuers report payment activity to credit bureaus. Additionally, many corporate cards offer rewards, cashback, and other perks, making them a valuable tool for businesses looking to maximize their expenses.

To Sum Up

Wallester offers a practical way to manage expenses, control employee spending, and maintain organized financial records. While they come with limitations, such as the inability to build credit or earn rewards, they can be a powerful tool for businesses that prioritize financial control and simplicity.

For businesses seeking more flexibility or additional perks, alternatives like corporate credit cards may be a better fit. By carefully evaluating your company’s financial needs, you can choose the right tools to streamline expense management and support your business’s growth.

-

Celebrity11 months ago

Celebrity11 months agoMichael C. Hall: Complex Journey of a Versatile Actor

-

Business11 months ago

Business11 months agoUnderstanding Apostille UK: A Comprehensive Guide

-

Technology11 months ago

Technology11 months agoThe Future of Video Marketing: Trends You Can’t Ignore

-

Celebrity12 months ago

Celebrity12 months agoShane Urban Explained: Facts About Keith Urban’s Sibling

-

Celebrity12 months ago

Celebrity12 months agoAnuel AA Height and Weight? Everything Age, Bio, Family, and More

-

Celebrity12 months ago

Celebrity12 months agoWho is Heidi Berry Henderson? Everything About Halle Berry’s Sister

-

Celebrity12 months ago

Celebrity12 months agoThe Life of Lorenzo Luaces: Lili Estefan’s Ex-Husband Explained

-

Celebrity1 year ago

Celebrity1 year agoOtelia Cox, Bio Tony Cox’s Wife, Her Age, Height, and Life Journey

-

Celebrity12 months ago

Celebrity12 months agoian cylenz lee: Bio, net worth, age, family and more Kandyse McClure’s husband

-

Entertainment1 year ago

Entertainment1 year agoEverything About ‘Oche Oche Anasico’ Lyrics: Meaning, Origin & More

-

Celebrity12 months ago

Celebrity12 months agoWho is Carolin Bacic? A Deep Dive into Steve Bacic’s Wife

-

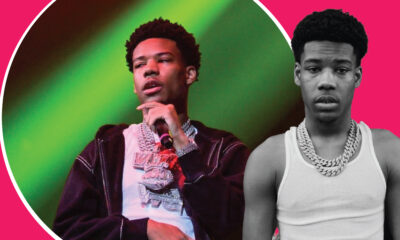

Celebrity12 months ago

Celebrity12 months agoDiscover Nardo Wick’s Age, Net Worth, Biography, Family, and More